The rough diamond sector is always rich in opportunities, yet it has proven to be difficult to penetrate for investors who are not proficient with the industry regulations.

If historically polished diamonds helped private investors to diversify their portfolios in order to retain, relocate and pass on wealth, the trade of rough diamonds is a much more elusive and exclusive domain of traders, cutters, institutional investors and sovereigns that stockpile as part of their investment regimes.

Monaco Life interviews Antonio Cecere, founder of Monaco Diamond Exchange, who formed Diamond Investment Club with the aim to bridge the gap between rough diamonds and investors.

ML: What is the Diamond Investment Club?

AC: It is an investment club by invitation only that has as sole focus that to offer its members the opportunity to finance spot trades in rough diamonds. It is the first investment club of its kind that is exclusively dedicated to rough diamonds; it enables investors to yield from single transactions in a secure and controlled environment.

ML: What prompted you to create Diamond Investment Club?

AC: I am the Chief Executive Officer of MC.EXCHANGE, operator in the rough diamond sector that procures parcels of rough diamonds and facilitates trades across the globe; this is achieved in full compliance with Kimberley Process Certification Scheme under the vigilance of Monaco Diamond Exchange. We were asked by members of Monaco Diamond Exchange and by some private banks to generate investment opportunities and bridge the gap between investors and the highly lucrative rough diamonds trades; a regulated fund was the obvious choice, however it presented a greater level of commitment from the investors. Therefore, I decided to create something that could offer returns on individual trades with trade-cycles that are objectively short.

ML: How does Diamond Investment Club work?

AC: Diamond Investment Club generates a trade periodically and circulates it amongst its members; as first step we select a licensed and registered diamond seller with export licence from MC.EXCHANGE portfolio of secured sellers; we then set the total value of the trade and the parameters of the parcel to mirror the requirements of a pre-selected buyer provided by MC.EXCHANGE that is ready, willing and able to purchase. Monaco Diamond Exchange supervises every step of the process to ensure conformity with industry regulations.

ML: In other words, are you saying that you line up a buyer before the asset is acquired?

AC: Correct. We do this to reassure the investors strong of a market scenario where demand is greater than supply. This enables us to enter the trade knowing already that the asset is sold to the end-buyer and at what price prior to the asset being purchased. We need to bear in mind that in the immediate future we will see rough diamond supply decrease by 1-2% a year and demand continue its historical growth trajectory of 3-4% a year. In the next couple of decades the widening gap between supply and demand will be significant and this physical asset will be fully commoditized; in this view some global banks already started stockpiling rough diamonds.

ML: How are the funds received and managed?

AC: In order to add a layer of protection for the investors, we decided to employ a European asset management company that is licenced, insured and regulated; the asset manager is responsible for the auditing of all investment activities, for the due diligence on the receivables to meet banking compliance as well as hold the capital. Further, it enables the Club to accept investments in a number of cryptocurrencies including Bitcoins, Ripple and Ethereum. The banks used have a physical presence in all continents which allows the Diamond Investment Club to receive deposits in a number of currencies, from US Dollar to Russian Ruble, and transfer funds internally to local branches to complete the trades in a timely manner.

ML: What returns on investment can be expected by the investors and how long does a single trade last?

AC: Set administrative costs per trade are less than 3.50% of the turnover and operational costs include transport, insurance, export taxes and Kimberley Process Certification. Returns on investment for the investor range from 3% to 6% on each trade depending on the size of the investment; risk is very moderate with funds being protected by the asset manager and then converted into a physical collateral that is insured for the duration of the trade; each trade is completed within 3 weeks and the investors can comfortably achieve ten trades a year.

ML: Where do the diamonds come from and where are they sold to?

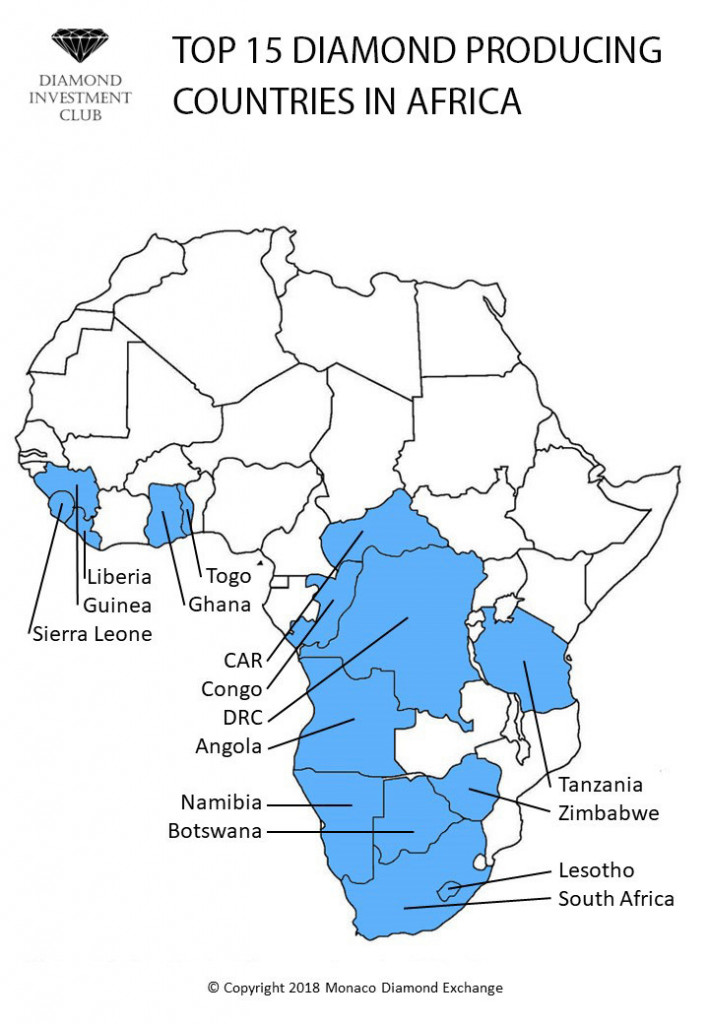

AC: We look at the trading conditions of a country and the ability of its diamond producers to export the mineral; we have established relationships with presidential cabinets and their ministers of natural resources across African countries; this enabled us to build working relationships with governmental mines, artisanal mines and exporters in Angola, Botswana, Namibia, Guinea, Sierra Leone, South Africa, Zimbabwe and Democratic Republic of Congo. For the resale of the diamonds we select either cutters and polishers from Surat and Tel Aviv, traders from Antwerp and Dubai or focus on institutional investors in New York, Geneva and Hong Kong.

ML: Do you think you bridged the gap between investors and rough diamonds with Diamond Investment Club?

AC: I believe we have. We transformed a rough diamond trade into a financial product for investors that in turn benefit from high returns with a thoroughly managed risk. We delivered what we were asked for by Monaco Diamond Exchange members and by the private banks for their clients and, in the process, we created something truly exceptional.